Amid the dynamic landscape of cryptocurrency trading where market conditions can change rapidly ability to manage risk effectively is paramount to achieving long-term success. Traders navigating the volatile waters of Binance Futures understand the importance of balancing potential rewards with potential losses. In this article, we will explore the intricate art of risk management and unveil how the Binance Futures Calculator serves as a powerful tool in this endeavor.

Cryptocurrency markets are notorious for their price volatility presenting both lucrative opportunities and significant risks. Traders whether seasoned veterans or novices need a robust risk management strategy to navigate the uncertainties and protect their capital. The Binance Futures Calculator emerges as a valuable ally in this quest providing traders with essential metrics and insights to make informed decisions.

This article aims to guide traders through the landscape of risk management shedding light on the fundamentals of Binance Futures and delving into the intricate workings of the Binance Futures Calculator. As we journey through this exploration we will uncover key metrics discuss implementation strategies examine real-life case studies and offer advanced tips to fortify your risk management arsenal.

Embark on this insightful journey to not only understand the nuances of risk management but also to harness the full potential of the Binance Futures Calculator in optimizing your trading endeavors.

Understanding Binance Futures

Cryptocurrency trading has evolved significantly and Binance Futures stands at the forefront of this evolution. In this section, we will delve into a comprehensive understanding of Binance Futures exploring its overarching principles distinctive features, and the opportunities it presents to traders. By gaining insight into the mechanics of BinanceFutures traders can make informed decisions and strategically navigate the complexities of this innovative trading platform.

Overview of Binance Futures

Binance Futures represents a derivative trading platform that enables users to speculate on the price movements of various cryptocurrencies. Offering a diverse range of trading pairs and advanced tools Futures caters to both novice and experienced traders seeking exposure to the dynamic cryptocurrency markets.

Key Features of Binance Futures

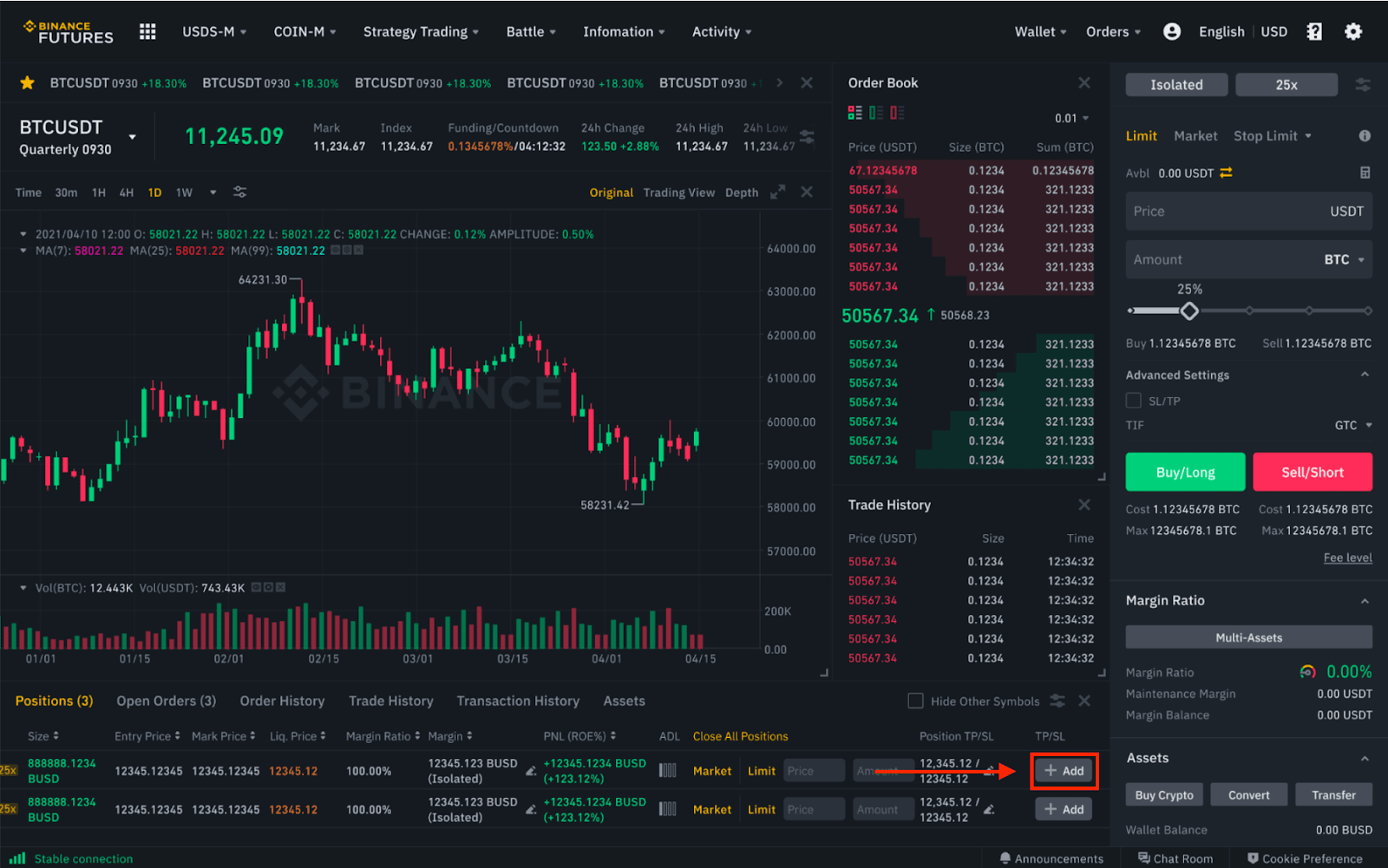

Delving deeper we will uncover the key features that distinguish Binance Futures in the cryptocurrency trading landscape. From leverage options to risk management tools understanding these features is essential for optimizing trading strategies and harnessing the full potential of the Binance Futures platform.

The Role of Risk Management in Trading

Effective risk management stands as the linchpin of success in the intricate realm of trading where financial markets can be unpredictable and dynamic. At its core risk management involves the systematic identification assessment and control of potential risks associated with financial transactions. This strategic approach is not merely a precautionary measure but a proactive and integral part of the trading process. Traders who embrace robust risk management practices demonstrate a commitment to preserving their capital mitigating potential losses and ensuring the longevity of their trading endeavors. In a landscape where market conditions can change rapidly the role of risk management becomes paramount guiding traders through uncertainties enabling them to make informed decisions and ultimately contributing to the achievement of sustainable success in the everevolving world of trading.

Introduction to the Binance Futures Calculator

In the dynamic world of cryptocurrency trading precision and informed decisionmaking are paramount. The Binance Futures Calculator emerges as a vital tool empowering traders to navigate the complexities of the market with greater accuracy. This section will provide an in-depth introduction to the Binance Futures Calculator exploring its purpose functionality and how it serves as an indispensable asset in formulating effective trading strategies.

What is the Binance Futures Calculator?

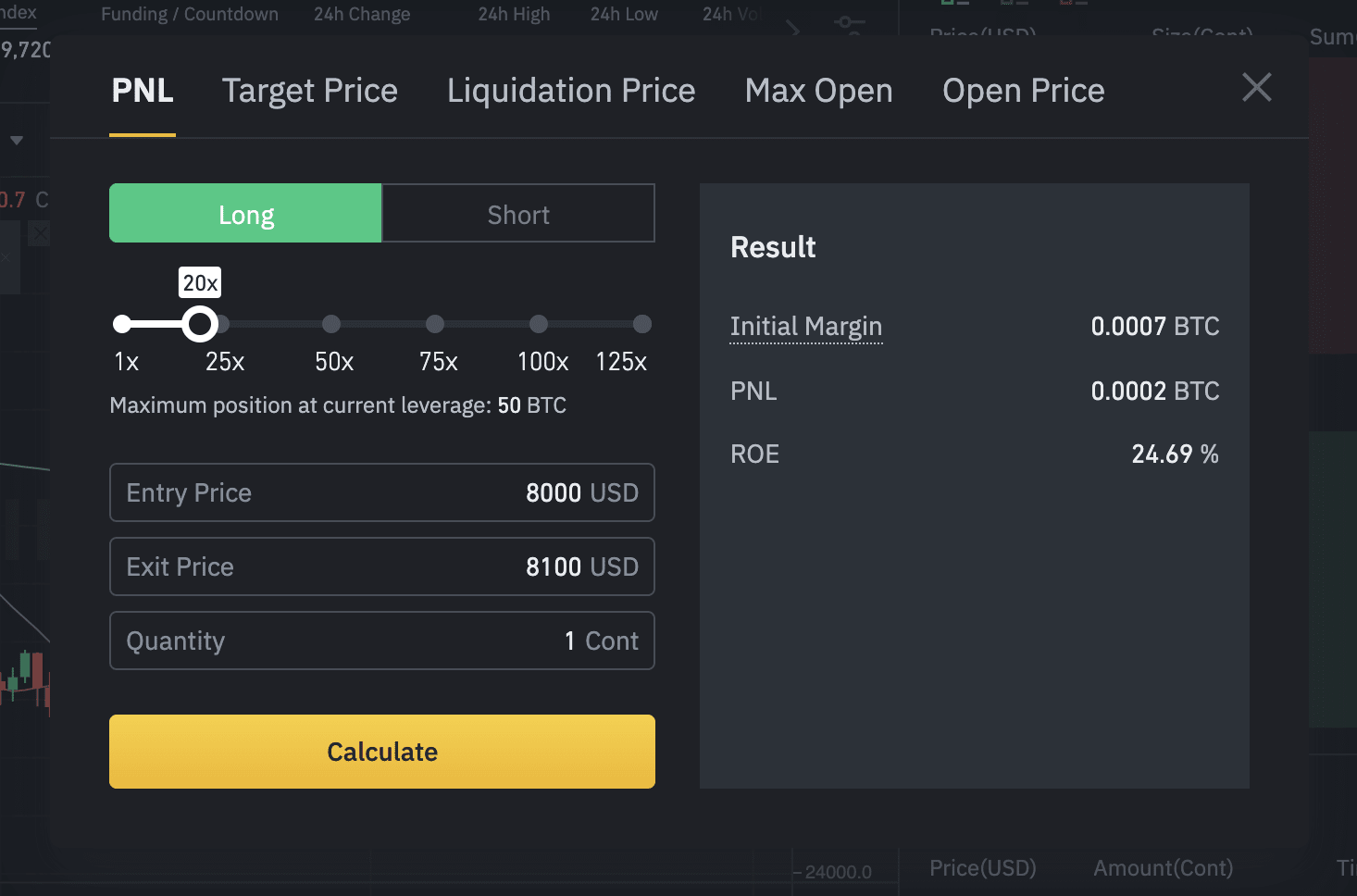

The Binance Futures Calculator is a specialized tool designed to assist traders in making precise calculations related to their futures trading activities on the Binance platform. It encompasses a range of features that enable users to evaluate key metrics such as position size leverage risk-reward ratios and potential profit and loss scenarios. By leveraging this calculator traders can enhance their risk management strategies and make well-informed decisions tailored to their individual risk tolerance and trading objectives.

How to Access and Use the Calculator

Understanding how to access and effectively utilize the Binance Futures Calculator is crucial for traders looking to optimize their risk management practices. This section will guide users through the steps of accessing the calculator on the Binance platform providing insights into its interface and illustrating how to perform essential calculations. As we delve deeper into the functionalities of this tool traders will gain a clearer understanding of how the Binance Futures Calculator can be a game-changer in achieving precision and efficiency in their trading endeavors.

Key Metrics in Risk Management

A fundamental aspect of successful trading lies in the ability to manage risk effectively. In this section, we will explore key metrics that play a pivotal role in risk management within the context of Binance Futures trading. Understanding these metrics is essential for traders seeking to optimize their positions calculate potential gains and losses and make informed decisions in the volatile cryptocurrency markets.

Leverage and its Impact

Leverage is a double-edged sword in trading amplifying both potential gains and losses. This subsection will delve into the concept of leverage and its impact on trading positions. Traders will gain insights into how to use leverage judiciously to enhance returns while considering the associated risks.

Position Size Calculations

Determining the appropriate position size is a critical aspect of risk management. This part of the discussion will focus on methodologies for calculating position sizes based on risk tolerance account size and market conditions. Proper position sizing is integral to mitigating potential losses and maintaining a balanced trading portfolio.

Setting StopLoss and TakeProfit Levels

Setting strategic stop-loss and take-profit levels is a cornerstone of risk management. Traders will learn how to establish these levels based on technical analysis of market conditions and their individual risk-reward preferences. This section will emphasize the importance of disciplined approaches to exit strategies in protecting capital and optimizing profitability.

As we explore these key metrics traders will gain a comprehensive understanding of the building blocks of effective risk management setting the stage for successful and sustainable trading strategies.

Implementing Risk Management Strategies with Binance Futures Calculator

As traders navigate the intricate landscape of Binance Futures the implementation of robust risk management strategies is paramount for sustained success. In this section, we will delve into practical approaches for leveraging the Binance Futures Calculator to implement effective risk management strategies. From calculating risk-reward ratios to adjusting leverage and incorporating diversification this exploration aims to empower traders with the tools and insights needed to make informed decisions in the dynamic world of cryptocurrency trading.

Calculating RiskReward Ratio

One of the cornerstones of risk management is the calculation of the risk-reward ratio. This subsection will guide traders on how to use the Binance Futures Calculator to assess the potential reward against the risk in a trade. Understanding and optimizing this ratio can significantly impact the overall profitability of trading strategies.

Adjusting Leverage for Optimal Risk

Leverage introduces an additional layer of complexity to trading and prudent adjustment is crucial. Here traders will learn how to use the Binance Futures Calculator to determine and finetune leverage levels according to their risk tolerance and market conditions. This strategic approach helps mitigate excessive risk while maximizing the potential for returns.

Using the Calculator for Diversification

Diversification is a key risk management strategy that involves spreading investments across different assets. The Binance Futures Calculator can be instrumental in assessing the impact of diversified positions on the overall portfolio. Traders will discover how to optimize their asset allocation to reduce risk exposure and enhance the resilience of their portfolios.

By the end of this section, traders will be equipped with practical insights into implementing risk management strategies with precision utilizing the Binance Futures Calculator as a dynamic tool in their arsenal. As the cryptocurrency market continues to evolve mastering these strategies becomes essential for navigating the everchanging landscape with confidence and resilience.

Read Also: Is it safe to invest in cryptocurrency now in 2024? Complete Guide for Beginners

Common Mistakes to Avoid

In the dynamic world of cryptocurrency trading success often hinges on avoiding common pitfalls. Here is a concise list of mistakes that traders should steer clear of to enhance their risk management practices and overall trading performance

- Failing to implement a structured risk management plan leaves traders vulnerable to substantial losses. Ignoring risk management principles is a recipe for financial instability.

- Neglecting to assess current market conditions can lead to misguided trading decisions. Traders must stay attuned to the ever-changing dynamics of the cryptocurrency market.

- Markets evolve and strategies that once worked may become obsolete. Failing to adapt and refine trading strategies according to market shifts can result in missed opportunities or increased risk.

- Trading without predefined stop-loss orders exposes traders to uncontrolled losses. Neglecting this fundamental risk management tool is a common oversight that can have severe consequences.

- Allowing emotions to drive trading decisions, especially in an attempt to recover losses often leads to impulsive and high-risk behavior. It’s crucial to maintain discipline and stick to a predetermined trading plan.

- Excessive trading can lead to increased transaction costs and greater exposure to market fluctuations. Traders should focus on quality trades based on sound analysis rather than succumbing to the temptation of frequent trading.

- Concentrating investments in a single asset or market exposes traders to heightened risk. Diversification is a key strategy for spreading risk and enhancing the stability of a trading portfolio.

- Relying solely on technical analysis without considering fundamental factors can result in an incomplete understanding of market dynamics. Both forms of analysis should be integrated for a comprehensive trading strategy.

Advanced Tips for Effective Risk Management

To get even better at managing risks in cryptocurrency trading try these advanced tips. First, be flexible with how much you invest based on what’s happening in the market. This is called dynamic position sizing. Second use hedging strategies which means using specific financial tools to balance out possible losses. Lastly, keep a close eye on the market and be ready to change your risk plans as needed. By following these advanced tips you can make your trading safer and better handle the unpredictable nature of cryptocurrency markets.

Final Thoughts

Mastering risk management strategies with the Binance Futures Calculator is pivotal for success in cryptocurrency trading. The calculator serves as a crucial ally offering precise calculations and insights. By understanding key metrics avoiding common mistakes and implementing advanced tips traders can fortify their positions and navigate the unpredictable nature of the market. The Binance Futures Calculator combined with disciplined risk management practices positions traders for resilience and success in the dynamic world of cryptocurrency trading.

Dilshad Mushtaq loves tech and he shares cool tech news, trends, and updates that everyone wants to understand and enjoy tech, whether you’re a pro or just getting started. Join him on BestSEOZones for simple, fun insights into the world of technology!